Introduction

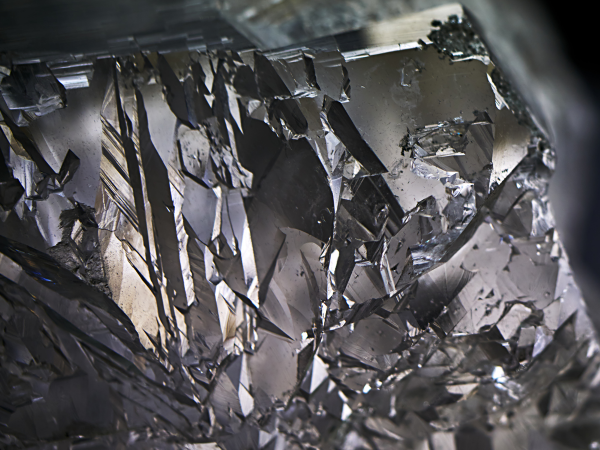

Currently, the silicon metal market appears calm, with little movement in spot prices and flat quote curves. But does that mean procurement risks are gone? Quite the opposite — when prices are stable and capacity is in surplus, it can signal underlying structural adjustments. This article highlights two critical issues buyers should not overlook during low-volatility periods.

Quote Vacuum: “Price Exists, Stock Doesn’t”

In recent quarters, we’ve seen suppliers continue quoting low prices without actual production or delivery capacity. For mid-grade products like 441 and 553, there have been cases of “prices on paper, no stock in reality.” SMM’s recent three-month report also shows stable spot quotes but declining transaction activity. This indicates a “quote vacuum,” where relying on the lowest offer increases the risk of delivery delays and off-spec material.

Capacity Mismatch and Regional Risks Are Building Up

Total silicon metal capacity may be high, but the sources “able to ship” are concentrated in a few major plants in Inner Mongolia, Yunnan, and Ningxia. If port congestion, stricter export policies, or rising domestic demand occur, available capacity does not guarantee smooth procurement. For example, in Q1 2024, exports from Southeast Asian countries (Indonesia, Vietnam) surged, causing severe berth congestion at southern Chinese ports. In February, Shanghai port’s delayed shipment rate rose to 18.3%. Buyers focusing only on FOB prices without supply chain node checks risk facing “right price, wrong logistics” delays.

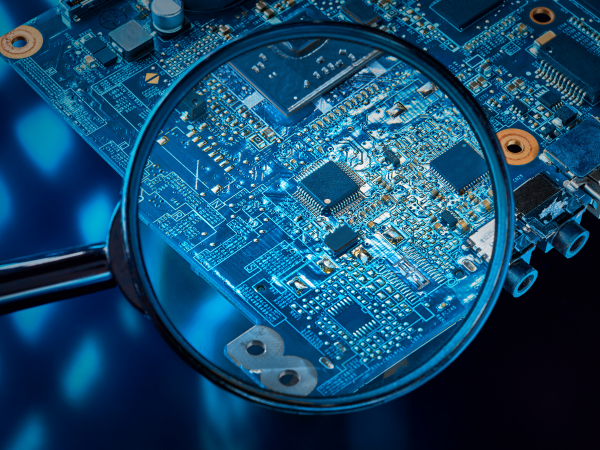

Suggested Strategies for a ‘False Calm’

| Factor | Procurement Advice |

|---|---|

| Price Stagnation | Compare SMM monthly averages + transaction volume ratio to spot fake quotes |

| Delivery Delays | Add delivery guarantee clauses and secure pre-scheduling with main suppliers |

| Regional Concentration | Negotiate with exporters at different ports to diversify port-related risks |

| Second Source | Maintain 20–30% alternative spot channels for flexibility |

🔗 Additional Resources

- 💬 SMM Silicon Metal Real-Time Prices

- 📦 Silicon Metal Supply Structure Analysis - IndexBox

- 🔗 5 Signs It’s Time to Switch Suppliers and How to Judge Spec Risks

FAQ: Questions Experts Ask in Calm Markets

Q1: Does stable pricing mean I can buy long-term?

A: Not necessarily. Check if it’s a true active trading zone or a quote vacuum by comparing “quotes vs. actual shipments.”

Q2: Which suppliers are most likely to have issues in calm periods?

A: Small plants and offers without COA or delivery commitments are the most likely to fail on delivery.

Q3: Do I still need a second supplier when prices are stable?

A: Yes. Stability often hides inactive trading. A second supplier ensures “buyability” as a safety valve.

Conclusion: Real Risks Hide in Calm Periods

A calm silicon metal market is often the hardest time to judge procurement. Seemingly stable prices may hide supply-demand imbalances, quote vacuums, and port risks. For professional aluminum procurement, the priority is not the lowest price, but the clearest structure and most controllable delivery model.

繁體中文

繁體中文  简体中文

简体中文  Español

Español  English

English